Whenever you invest in the stock market, the risk remains, you should know that there are two types of risk.

- systematic risk

- unsystematic risk

Systematic Risk:

Changes in the company in risk such as loss of earnings, reduction in margins, mistakes of the operators, the future of the company, the company's strong competitor, due to the fall in the stock prices. If the entire market is falling, due to a fall in GDP, geopolitical risk, inflation, interest rate, due to any reason, then o systematic risk can fall.

Unsystematic Risk:

In a risk, the stock prices fall due to the external problems occurring in the company. If there is a fall in the stock prices due to a specific event happening in the company, whatever loss will happen due to it is called unsystematic risk.Then there will be no decline in any index of the market or in other stock or any sector's stock because due to some special event happening in the company, the stock prices are falling due to which it does not affect the other stock.

You will say that what do we mean by that, what kind of risk we have, if we are at risk in any way, if we reduce it, then diversification will have to be done for that .

Instead of investing all the money in one company, we can invest money in different companies so that we can diversify the risk.

You must have heard the saying that does not keep all the eggs in one basket because if the basket falls, all the eggs will break, the same proverb also applies that all the money should not be put in one stock.

Let us understand with an example that the pcj started falling on the high of 600 and today it is running at 27. If all the money was put in one stock, then all the money would have been lost, so diversification is very important.

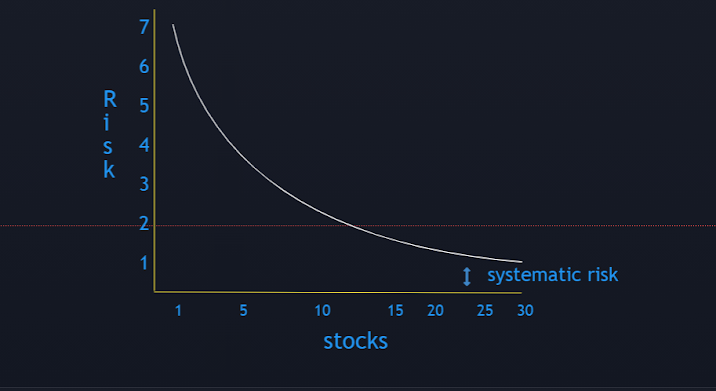

Now, how many different stocks we have invested in, understand the chart given below for that.

You can see in the chart that the number of winning stocks is increasing and thus the risk is decreasing.

I mean to say that do not put all the money in 1 stock, put it in more stocks so that unsystematic risk can be avoided. It doesn't mean to put money in 20-40 different stocks, because there is more stock to win than 15, there will be a systematic risk in that, if we have a fall in the stock prices due to any special event happening in the company, then its Whatever happens because of it, it should be avoided. When pcj fell, it had no effect on the market.

If the entire market is falling, due to a fall in GDP, geopolitical risk, inflation, interest rate, if the market falls due to any reason, then o systematic risk can also increase.

Comments

Post a Comment