Volume :

Volume comes on the buyer and seller of a stock, some people do not know how to count the volume, suppose 100 buyers and 100 sellers of SBI stock, then some people who buy 100 and sell 100 total 200 volumes But A is not correct. It is correct that 100 buyers and 100 sellers make a total of 100 volumes (Q's SBI stock is going to buy 100, so if there are 100 sellers, then the only O will be able to buy) In total volume count 100+100 = 100 only.

When does a volume trader come in handy?

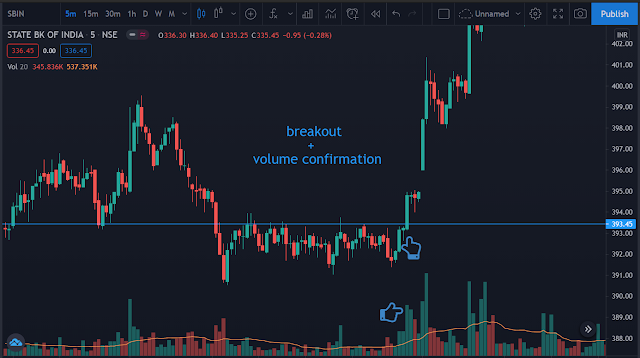

Let's talk about that. When the trader uses the confirmation while taking the trade, if there is a breakout, it is right? It's not a fake breakout, is it? The rest is of no use to it. The same volume is to be kept in mind which is above the average volume line.

Is there a myth about the volume in the minds of some people?

If the color of the candle is red, then the color of the volume will also appear red, then some people assume that at this time only sellers are present, but A is not true, Q is going to buy SBI stock, so are the sellers too Only then will you be able to buy. And the important thing is that coke is not even the color of the volume, the volume of the q is the volume, but the color of all the web content appears to be the color of the same volume.

Volume is not a buy signal or a sell signal.

You can't trade just by looking at the volume.

Sometimes the volume tells us about the movement on the stock after a long time, as it is showing in this stock. Next, you yourself are wise

Moving Average

Moving average is a line that is made up of an average of stock prices. Let be 50MA ( Moving Average) i.e. Average price of the closing price of 50 Kandel If 100 MA then the Average price of the closing price of 100 Kandel

Moving Average includes SMA(Simple Moving Average) and EMA(Exponential Moving Average).

The question must have come to your mind that what are SMA and EMA? Oh, it will be found anywhere, but I will tell you which one to use and why?

We have to use EMA(Exponential Moving Average). That's why the EMA itself gives an absolutely accurate average of the price of the stock because it uses the data of Zayed and Zayed. As compared to SMA, I know many questions must have come to your mind that if I have not told you about sma and ema, then any indicator should be used for a trader. Not what is his formula? How does it happen? ... I know that I did not tell you about the moving average, so I would say that you use any moving average. EMA(Exponential Moving Average) is correct. The intraday trader should use the 50 and 200 EMA in the time frame of 15 minutes.

Comments

Post a Comment